The Term Used to Describe an Unsecured or Non-collateralized Bond.

The only thing that provides security for the lender is your credit worthiness which is usually determined by your credit score and credit history. A term bond refers to a bond that matures on a single specific date in the future.

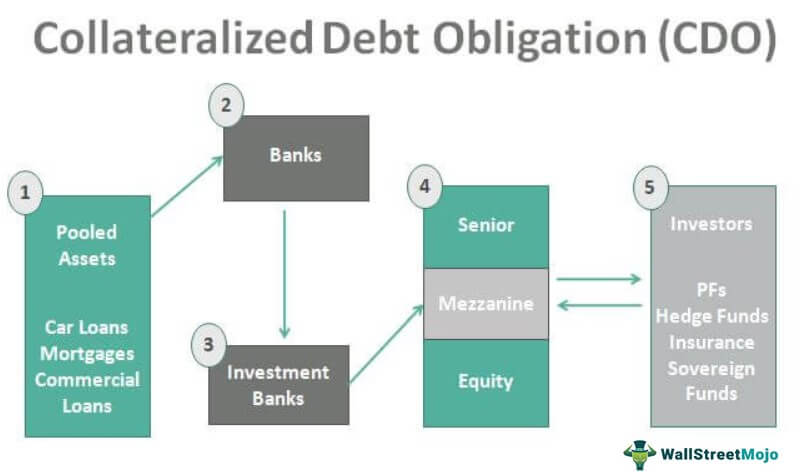

Collateralized Debt Obligations Cdo Step By Step Guide To How It Works

A type of bond that allows the bond issuer to retain the privilege of redeeming it at a pre-specified price at some time prior to its normal maturity date.

. A type of bond that allows the bond issuer to retain the privilege of Current yield redeeming it at a pre-specified price at some time prior to its normal maturity date. This doesnt necessarily have to. Investment grade bond The term applied to bonds that are judged by their rating agency as being likely to pay their interest and maturity obligations.

The bond as we commonly know it is a senior unsecured debenture. The term used to describe an unsecured or non-collateralized bond. Summarize the bankruptcy process and bondholder rights.

To complicate matters this is the American definition of a debenture. The term used to describe an unsecured or non-collateralized bond. BThe portion of a bondholders return that results from a bonds interest payment calculated by dividing the bonds interest payment by its market.

Bondsdocx from ACC 1A 1B at University of Santo Tomas. In British usage a debenture is a bond that is secured. Describe secured debt unsecured debt and credit enhancements for corporate bonds.

Investment grade bond A bond that has been judged by credit rating agencies as having a relatively low probability of default on the payment of its interest and maturity payment. Callable bonds D B. Unsecured bonds are not secured by a specific asset but rather by the full faith and credit of the issuer.

Investment-Grade bond The term applied to bonds that are judged by their rating agency as being likely to pay their interest and maturity obligations. The collateral has to. The term used to describe an unsecured or non.

Describe a medium-term note and explain the differences between a corporate bond and a medium-term note. The term used to describe an unsecured or non-collateralized bond investment grade bond a bond that has been judged by credit rating agencies as having a relatively low probability of default on the payment of its interest and maturity payment. The asset serves as collateral for.

Unsecured Bonds. Investment grade bond The term applied to bonds that are judged by their rating agency as being likely to pay their interest and maturity obligations. Bonds in this category are often referred to as debentures.

If the collateral is real property there will be either a mortgage or a deed of trust. The term applied to bonds that are judged by their rating agency as being likely to pay their interest and maturity obligations Atype of municipal bond whose interest and maturity payments are paid using funds generated by the project being financed Cmdo It Now Santa. The term used to describe an unsecured or non-collateralized bond.

Variable-rate demand obligation VRDO. A short-term unsecured promissory note is the type most often used when a. An unsecured loan is a loan that has no collateral as backing for the loan.

This is unsecured debt meaning no collateral exists to guarantee at least a portion. A secured bond is a type of investment in debt that is secured by a specific asset owned by the issuer. Match each letter to one option.

At the time the bonds face value ie the principal amount must. The term used to describe an unsecured or non-collateralized bond. The property that secures a note is called collateral which can be either real estate or personal property.

The term used to describe an unsecured or non-collateralized bond. List the factors considered by rating agencies in assigning a credit rating to corporate debt. In other words the investor has the issuers promise to repay but has no claim on specific collateral.

Describe secured debt unsecured debt and credit enhancements for corporate bonds. It is probably easiest to describe what we all know a bond then highlight the differences from there. A collateral trust bond is a type of secured bond in which a corporation deposits stocks bonds or other securities with a trustee so as to back its bonds.

A promissory note secured by collateral will need a second document. The term used to describe an unsecured or non-collateralized bond. The term itself bond.

1 Secured loans are less of a risk to lenders since the collateral can be seized and sold if the borrower defaults. The term used to describe an unsecured or non-collateralized bond Investment-grade Bond a bond that has been judged by credit rating agencies as having a relatively low profitability of default on the payment of its interest and maturity payment. Such unsecured bonds only have the issuers.

A bond that is not secured by collateral. Whenever a bond is unsecured it can be referred to as a debenture. Unsecured loans have higher interest rates since theyre a higher risk to.

Secured loans typically have lower interest rates than unsecured loans. Basic concepts Select the correct term for each of the following descriptions. A long-term bond the interest rate of which is adjusted periodically typically based upon specific market indicators.

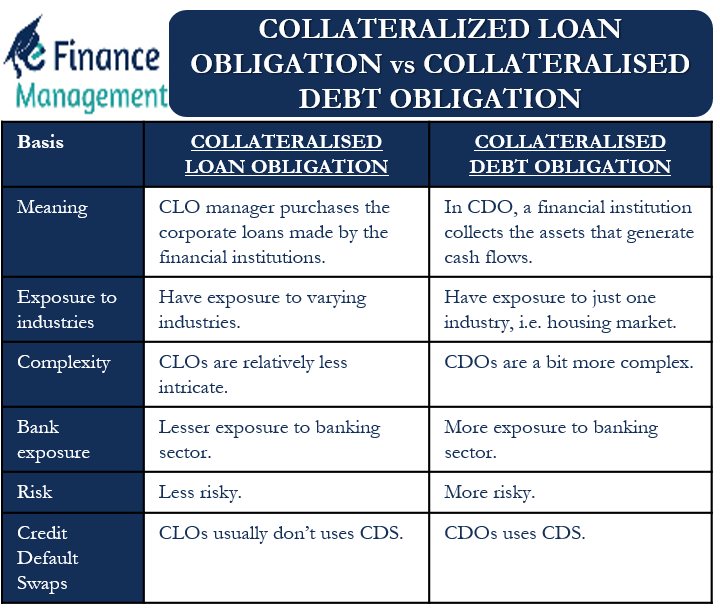

Introduction To Collateralized Debt Obligations

/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

Comments

Post a Comment